Funeral cover, or final expense insurance, is a safety net for covering the substantial costs of funerals and final arrangements, providing peace of mind during emotional times. Comparing Funeral Cover Quotes is crucial for securing optimal value tailored to individual needs and budgets. This process involves researching different plans and providers, understanding inclusions like burial/cremation expenses, grief support, and memorial services. Getting multiple quotes from various insurers allows for comprehensive comparisons, with factors like age, health, and group memberships potentially lowering premiums. Proactive planning, including obtaining Funeral Cover Quotes, ensures financial security for families, honoring loved ones without compromising financial stability.

“In a sensitive and often overlooked aspect of life planning, finding affordable funeral cover is a crucial step in ensuring your final wishes are respected without breaking the bank. This article guides you through the process of understanding funeral cover, its significant benefits, and practical strategies to obtain the best funeral cover quotes. Learn how comparing quotes can lead to substantial savings, and discover top tips for securing cost-effective coverage, leaving you with peace of mind.”

- Understanding Funeral Cover: What You Need to Know

- The Benefits of Comparing Funeral Cover Quotes

- How to Get Accurate Funeral Cover Quotes

- Top Strategies for Securing Affordable Funeral Cover

- Real-World Examples: Success Stories of Cost-Effective Planning

Understanding Funeral Cover: What You Need to Know

Funeral cover, also known as burial or final expense insurance, is a financial safety net designed to help families navigate the often significant costs associated with a loved one’s funeral and final arrangements. It provides peace of mind by guaranteeing that your final wishes will be respected without placing a burden on your family during an already emotional time. This type of coverage can cover various expenses, including but not limited to, burial or cremation costs, funeral home services, cemetery plots, and even memorial markers.

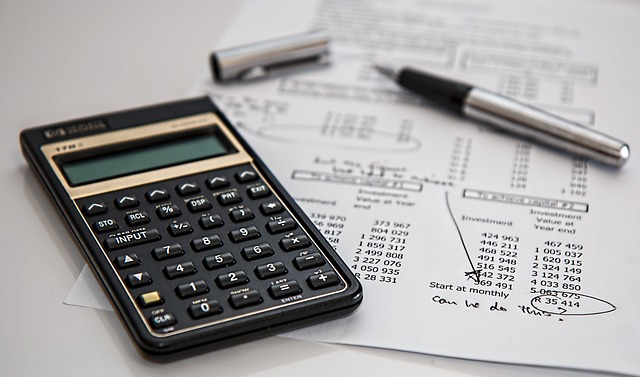

Obtaining Funeral Cover Quotes is an essential step in ensuring you receive the best value for your money when planning for these eventualities. By comparing quotes from different providers, you can find affordable options tailored to your specific needs and budget. This proactive approach allows you to make informed decisions about your funeral cover, ensuring that you’re protected without overspending.

The Benefits of Comparing Funeral Cover Quotes

Comparing funeral cover quotes is an intelligent step in ensuring you get the best value for your money during a difficult time. By taking the time to research and contrast various providers, you can uncover substantial savings and find a plan that aligns with your budget and preferences. This process allows individuals to make informed decisions about their end-of-life arrangements, knowing they’ve secured affordable coverage without compromising on quality.

When you compare quotes, you gain access to diverse offerings from multiple funeral service providers, enabling you to assess the range of services included in each plan. This comprehensive view helps identify options that offer exceptional value, including extensive coverage for burial or cremation expenses, as well as additional benefits like grief support services and memorial celebration assistance.

How to Get Accurate Funeral Cover Quotes

Getting accurate Funeral Cover Quotes is a crucial step in ensuring you and your loved ones are prepared for the future. The first step is to understand what’s available. Research different funeral plans and providers, comparing their offerings based on cost, coverage, and benefits. Many companies now offer online quote tools that allow you to input personal details like age, location, and preferred burial or cremation options. This instantly generates a range of tailored quotes for comparison.

Additionally, reach out directly to several funeral homes and insurance providers. They can provide detailed information on their plans and pricing structures. It’s important to ask questions about what’s included in the quote, such as burial expenses, crematorium costs, and any additional services like grief counselling or memorial planning. This ensures you have a comprehensive understanding of your options before making a decision.

Top Strategies for Securing Affordable Funeral Cover

Securing affordable funeral cover can be a daunting task, but with the right strategies, it becomes more manageable. One effective approach is to get multiple Funeral Cover Quotes from different providers. Shopping around allows you to compare costs and benefits, ensuring you find the best value for your needs. Online platforms and comparison tools make this process seamless, enabling you to access quotes from various insurers in minutes.

Additionally, consider your age and health status when evaluating options. Younger individuals often benefit from lower premiums, as do those with good health. Some providers offer discounted rates for specific groups, such as seniors or members of certain organizations. Reviewing policy terms and conditions is also crucial, as certain exclusions or limitations can impact the overall affordability.

Real-World Examples: Success Stories of Cost-Effective Planning

In a world where unexpected events can significantly impact our financial stability, planning ahead for the inevitable becomes crucial. Many individuals often overlook the importance of obtaining Funeral Cover Quotes until it’s too late. However, real-life examples illustrate that thoughtful, cost-effective planning can provide immense peace of mind. Consider a middle-aged couple who, after reviewing various Funeral Cover Quotes, decided on a policy that not only covered their funeral expenses but also included a small savings component for future medical needs. This proactive approach ensured that their loved ones would be financially secure during an emotionally challenging time without breaking the bank.

Another success story involves a young professional who, understanding the value of long-term financial planning, incorporated Funeral Cover Quotes into his comprehensive insurance portfolio. By doing so, he secured not only his own burial preferences but also contributed to a fund that supported his family’s immediate and future financial obligations. These stories underscore the power of being prepared and how accessible Funeral Cover Quotes can be, offering individuals and families a chance to honor their loved ones without compromising their financial stability.